Renters Insurance in and around Springdale

Looking for renters insurance in Springdale?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - size, utilities, location, townhome or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Springdale?

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

The unpredictable happens. Unfortunately, the stuff in your rented home, such as a microwave, a couch and a tool set, aren't immune to fire or tornado. Your good neighbor, agent Tim Pruitt, has a true desire to help you figure out a policy that's right for you and find the right insurance options to protect your belongings from the unexpected.

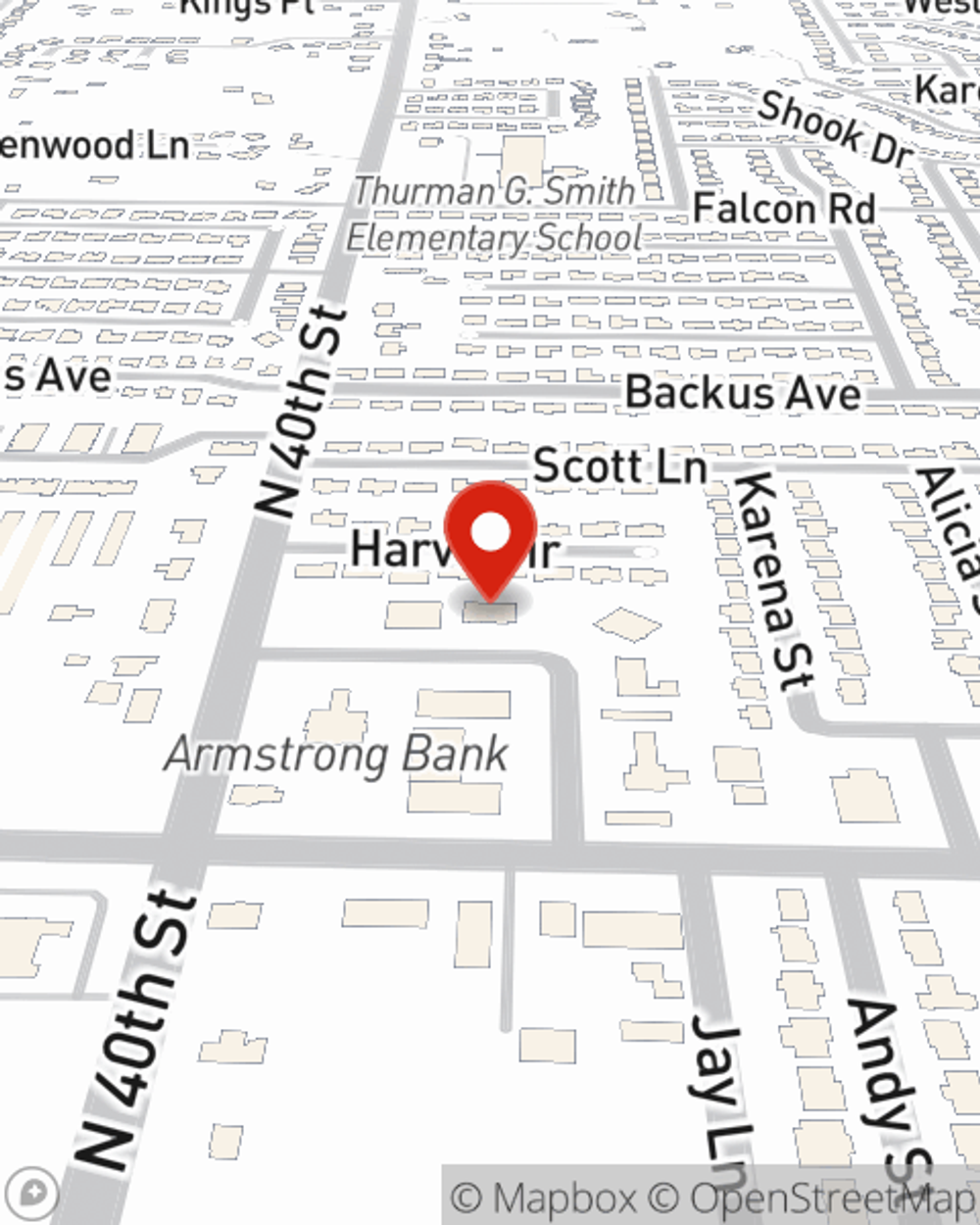

Get in touch with State Farm Agent Tim Pruitt today to find out how the leading provider of renters insurance can protect items in your home here in Springdale, AR.

Have More Questions About Renters Insurance?

Call Tim at (479) 751-6227 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.